- Iceland Should Abandon The Krona And Use Bitcoin

- IRS Taxing Bitcoins

- Coin Ticker iPhone App

- Top 10 Bitcoin Merchant Sites

- Why Didn’t Bitcoin Users Freak Out In May?

- OKPay Turns Back on Bitcoin

- China’s Currency War

- How Hackers Could Burst The Bitcoin Bubble

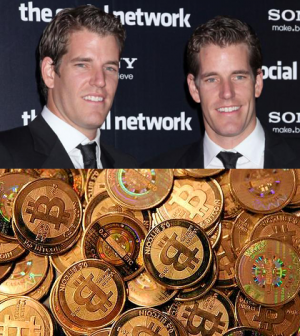

- Winklevii & Bitcoin

- OpenCoin Builds Universal Payment Ecosystem

Winklevii & Bitcoin

The Winklevoss twins, Cameron and Tyler are laying claim to a new title: bitcoin moguls.

The Winklevii, as they are known, have amassed since last summer what appears to be one of the single largest portfolios of the digital money, whose wild gyrations have Silicon Valley and Wall Street talking. The twins, the first prominent figures in the largely anonymous bitcoin world to publicly disclose a big stake, say they own nearly $11 million worth.

Or at least $11 million as of Thursday morning — when trading was temporarily suspended after the latest and largest flash crash left a single bitcoin worth about $120 and the whole market worth $1.3 billion. At one point, the price had plummeted 60 percent.

In addition to the identical twins, Silicon Valley investment firms, while not holding bitcoins, are starting to show interest in the technology.

On Thursday, a group of venture capitalists, including Andreessen Horowitz, announced that they were financing a bitcoin-related company, OpenCoin.

“People say it’s a Ponzi scheme, it’s a bubble,” said Cameron Winklevoss. “People really don’t want to take it seriously. At some point that narrative will shift to ‘virtual currencies are here to stay.’ We’re in the early days.”

http://dealbook.nytimes.com/2013/04/11/as-big-investors-emerge-bitcoin-gets-ready-for-its-close-up/

*Excerpt from The New York Times. News article copyright Nathaniel Popper and Peter Lattman at Dealbook.

You must be logged in to post a comment Login